Southeast Asian E-commerce is prosperous as ever, thanks to a combination of increasing choices, better access to the Internet, and rising affluence, along with that is the complicated behavior of online shopping consumers. A survey named “Riding the Digital Wave: Southeast Asia’s Discovery Generation”, conducted by Facebook and Bain & Company provides us with valuable insights regarding this promising sector. The study draws information from nearly 13,000 E-commerce users and providers in major markets: Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam; interviews more than 30 CEOs and venture capitalists in the region to come to the conclusion. And in this article, Omisell will point out their online shopping behavior.

Soaring numbers

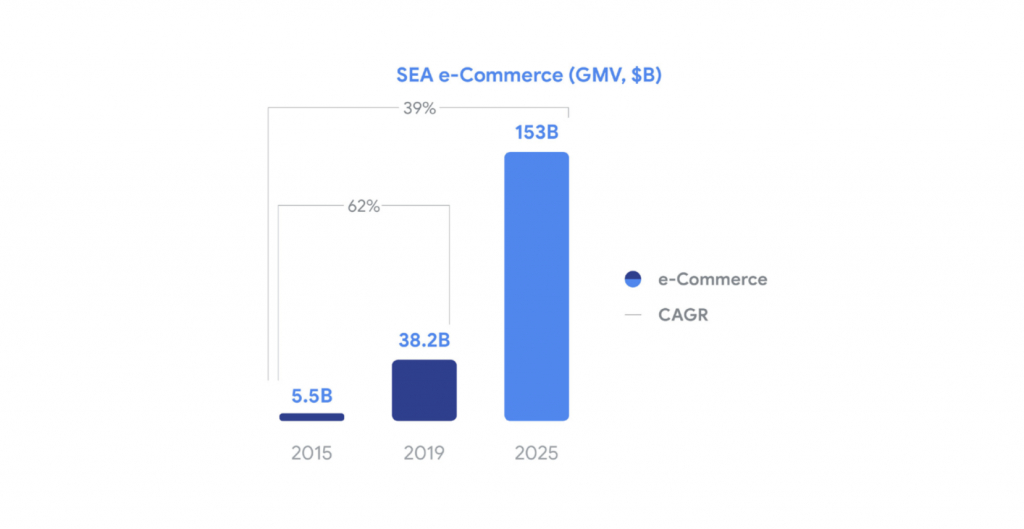

Southeast Asia, home to more than 640 million people, recorded a 2.8 times growth from 90 million digital consumers in 2015 to 250 million in 2018. In the same period, E-commerce value expanded seven times from USD 5.5 billion to USD 38 billion, surpassing Online Travel as the biggest Internet economy sector.

Southeast Asians rely heavily on their phones, with 90% of the online population using smartphones as the primary device to connect to the Internet. One online shopper spends an average of USD 125 on online purchases annually in 2018, which is considered a fairly large sum of money in these countries. 70 to 80% percent of these consumers are from the middle class as a result of a rise in incomes and Internet exposure.

Driven by online shopping portals like Lazada, Shopee, and many local startups, online shopping has slowly become a familiar habit for Southeast Asians. Sales are promotions are also great boosters, as Lazada report 20 million users shopping for Singles’ Day deals across the six countries they operate in.

How customers shop

Social platforms continue to be a strong promotion channel, as more than half of the respondents saying they learn about new products and brands on social media. Two-third of them also come to shopping portals with no specific products in mind. This indicates that online customers are very open to new suggestions, which is proved by the percentage of shoppers trying out new stores that they have never heard of before being more than 40%.

Southeast Asians express a strong preference for omnichannel shopping. A common buyer usually shop-hop across 3.8 platforms before making a purchase decision. They are also very price-conscious for comparing prices across platforms, both online and offline for any wanted item. Price, along with interesting products and positive reviews are the top 3 reasons for a customer to seal the deal.

E-commerce is no longer a platform for big-ticket items but it also expanded to low-cost daily products like groceries, clothing, and personal care. With a customer base that is open to discovery, there are opportunities for businesses of all niches and sizes to compete for the spotlight. However, the low returning rate also signals that E-commerce sellers should prioritize their customer rewards and loyalty programs.

According to the study, customers in loyalty programs are 50% more likely to promote the brand than normal customers. In particular, they are 45% more inclined to recommend cross-category, purchase 25% more frequently and spend 25% more on average.

Future predictions

The E-commerce community is expected to reach the 310 million users milestone in 2025, with every buyer spending USD 390 annually – triple the current amount. With this prediction, 2025’s total Gross Merchandise Volume (GMV) will exceed USD 150 billion, which is USD 50 billion more than the previous estimation (Google, Temasek, Bain & Company study).

Southeast Asia will also be seeing revolutions in many new sectors like education, health, and finance being digitalized. Online financial services, especially online payment is set to grow to USD 1 trillion in 2025. The Internet economy wave, which is focusing on top-tier cities, will spread to lower-tier cities and rural areas.

Southeast Asia will also be seeing revolutions in many new sectors like education, health, and finance being digitalized. Online financial services, especially online payment is set to grow to USD 1 trillion in 2025. The Internet economy wave, which is focusing on top-tier cities, will spread to lower-tier cities and rural areas.

There is a lot of potential for Southeast Asian E-commerce to keep developing. Amid the battle between major players, consumers across the region can enjoy more values, choices, and convenience. A researcher suggests that “Brands need to be very savvy and re-imagine their marketing and trade spend to be in sync with the ever-evolving omnichannel consumer journey. They also need to build new muscles to ensure a positive online shopping experience to their digital consumer.”